In order to ensure that you have accurate, reliable, actionable insights, it is vital to evaluate the AI and machine-learning (ML), models used by trading and prediction platforms. Models that are poorly designed or has been over-hyped can lead to inaccurate predictions and financial losses. Here are ten of the most effective ways to evaluate the AI/ML model used by these platforms.

1. Understand the Model's Purpose and Method of Approach

Clear goal: Determine whether the model was designed to be used for trading in the short term, long-term investment, sentiment analysis or risk management.

Algorithm transparency: Check if the platform reveals the types of algorithms employed (e.g. Regression, Decision Trees Neural Networks and Reinforcement Learning).

Customizability: Determine whether the model is able to adapt to your particular strategy of trading or risk tolerance.

2. Evaluation of Performance Metrics for Models

Accuracy: Examine the accuracy of predictions made by the model and don't solely rely on this metric, as it could be misleading when it comes to financial markets.

Recall and precision - Assess the model's ability to identify real positives and reduce false positives.

Risk-adjusted Returns: Determine whether a model's predictions yield profitable trades taking risk into account (e.g. Sharpe or Sortino ratio).

3. Check the model by Backtesting it

Historic performance: Use previous data to test the model to determine the performance it could have had in the past under market conditions.

Test the model on data that it has not been trained on. This will help stop overfitting.

Scenario Analysis: Review the model's performance under different market conditions.

4. Check for Overfitting

Signals that are overfitting: Search models that do extraordinarily well with data training, but not so well on data that is not seen.

Regularization: Determine if the platform employs regularization techniques, such as L1/L2 or dropouts to prevent excessive fitting.

Cross-validation: Make sure the platform employs cross-validation in order to determine the generalizability of the model.

5. Review Feature Engineering

Relevant features: Check whether the model is using relevant features (e.g. volume, price technical indicators, sentiment data, macroeconomic factors).

Selection of features: Make sure that the system chooses features that are statistically significant and do not include irrelevant or redundant data.

Updates to dynamic features: Verify that your model is up-to-date to reflect the latest characteristics and current market conditions.

6. Evaluate Model Explainability

Readability: Ensure the model is clear in its explanations of its predictions (e.g. SHAP value, importance of particular features).

Black-box models: Beware of applications that utilize overly complicated models (e.g. deep neural networks) without explainability tools.

User-friendly insights: Find out if the platform can provide useful insights for traders in a way that they are able to comprehend.

7. Examine Model Adaptability

Market shifts: Determine if the model can adapt to market conditions that change (e.g., new rules, economic shifts, or black swan-related events).

Continuous learning: Check whether the platform continually updates the model to include new information. This can improve performance.

Feedback loops: Ensure that the platform is incorporating feedback from users or real-world results to refine the model.

8. Examine for Bias or Fairness.

Data bias: Verify that the training data are representative of the market, and that they are not biased (e.g. overrepresentation in certain times or in certain sectors).

Model bias: Determine whether the platform is actively monitoring the biases of the model's prediction and if it mitigates the effects of these biases.

Fairness - Ensure that the model is not biased towards or against certain sectors or stocks.

9. Evaluation of the computational efficiency of computation

Speed: Evaluate whether you can predict with the model in real-time.

Scalability: Verify if the platform can handle huge datasets and a large number of users without affecting performance.

Resource usage: Determine if the model uses computational resources effectively.

Review Transparency and Accountability

Model documentation: Ensure that the platform provides complete documentation about the model's architecture, the training process as well as its drawbacks.

Third-party audits: Determine if the model has been independently verified or audited by third-party audits.

Error handling: Verify that the platform has mechanisms to identify and fix models that have failed or are flawed.

Bonus Tips

User reviews and Case Studies Review feedback from users and case studies to determine the real-world performance.

Trial period: Use a free trial or demo to test the model's predictions and the model's usability.

Customer support - Make sure that the platform is able to offer a solid support service to solve problems related to model or technical issues.

Following these tips can assist you in assessing the AI models and ML models that are available on stock prediction platforms. You will be able determine whether they are honest and reliable. They should also align with your goals for trading. Read the top AI stock picker tips for site info including best ai for trading, using ai to trade stocks, ai for trading, AI stock, AI stocks, AI stocks, trading ai, options ai, options ai, ai for stock trading and more.

Top 10 Tips For Evaluating The Trial And Flexibility Of Ai Software For Predicting And Analyzing Stocks

Before signing to a long-term agreement, it's important to test the AI-powered stock predictions and trading platform to see if they suit your needs. These are the top 10 ways to evaluate these aspects:

1. Try a Free Trial

TIP: Ensure that the platform you're considering has a 30-day trial to test the capabilities and features.

The platform can be evaluated for free.

2. Limitations on the duration and limitations of Trials

Tips: Check the length and restrictions of the trial (e.g. limitations on features or access to data).

What's the point? Understanding the limitations of an experiment can determine if it's a comprehensive review.

3. No-Credit-Card Trials

Look for trials which do not require credit cards to be paid in advance.

Why: This will reduce the chance of unexpected charges and will make it easier for you to opt out.

4. Flexible Subscription Plans

TIP: Make sure that the platform provides flexibility in subscriptions (e.g. quarterly or annually, monthly) and clearly defined pricing levels.

Why flexible plans let you to select a level of commitment that is suitable to your budget and needs.

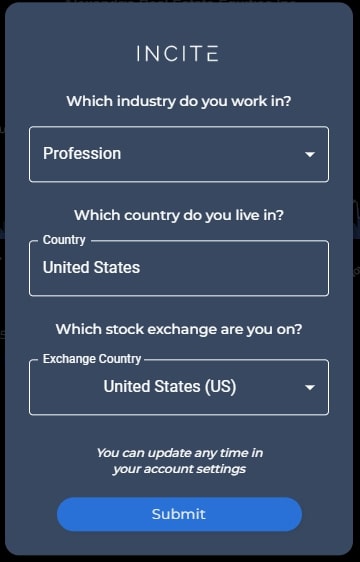

5. Customizable features

TIP: Make sure the platform permits customization of features like alerts, risk levels, or trading strategies.

The reason: Customization will ensure that the platform can be adapted to your individual needs and goals in trading.

6. The ease of cancellation

Tips - Find out the process for you to lower or unsubscribe from the subscription.

The reason: By allowing you to leave without hassle, you can be sure that you don't get stuck on an arrangement that's not suitable for you.

7. Money-Back Guarantee

Check out platforms that offer a 30-day money-back guarantee.

This is to provide an additional safety net should the platform not live up to your expectations.

8. Trial Users Have Access to all Features

TIP: Make sure the trial version has all the features that are essential and is not a limited edition.

You can make a more informed decision by trying the whole features.

9. Customer Support for Trial

Test the quality of the customer service during the free trial period.

Why is it important to have dependable support in order that you can solve issues and get the most out of your trial.

10. After-Trial feedback Mechanism

Make sure your platform is soliciting feedback for improving services following the trial.

Why The platform that takes into account feedback from users is more likely to evolve so that it can meet the demands of users.

Bonus Tip Tips for Scalability Options

You must ensure that the platform can scale to meet your requirements, providing more features or plans at a higher level as your trading activity grows.

If you think carefully about these options for testing and flexibility, you will be able to make an informed choice about whether an AI stock prediction platform is the best option for you. Have a look at the most popular stocks ai for more examples including ai trading tool, ai in stock market, can ai predict stock market, ai in stock market, free ai tool for stock market india, ai software stocks, ai in stock market, best ai for stock trading, AI stock trader, AI stock price prediction and more.